83% of New Businesses do not Access Capital from Banks

In the 2019 report, we found that 90% to 95% of businesses with employees will need some capital to start their business and that 83% of those businesses do not access capital from external private institutions (e.g. bank loans). These numbers have not changed since 2019. Help is available!

Changes to SBA Loans - June 2025

Changes to SBA Loans…

The SBA’s new rules (SOP 50 10 8) are bringing major shifts for small-business borrowers:

✅ Ownership & Eligibility

100% of owners must be U.S. citizens, nationals, or lawful permanent residents.

Lenders must verify citizenship + ownership details for all key people.

✅ Underwriting Tightens

“Do What You Do” flexibility is gone — back to conservative underwriting.

Minimum SBSS score raised to 165.

Startups / ownership changes require 10% equity injection.

Hazard & life insurance required in more cases.

✅ Loan Size & Fees

“Small loan” threshold lowered to $350K (from $500K).

SBA guaranty & lender fees reinstated.

✅ Program Updates

Community Advantage expansion paused.

SBA refocusing on portfolio health & risk management.

💡 What it means for borrowers:

More documentation.

Higher credit standards.

Less flexibility.

Slightly higher costs.

…No change in funding times…still 2-3 months

Applies to all new loans issued June 1, 2025 and after.

Small Business Bankers - Retain Clients

Calling all Small Business Bankers…

What do you do with your “declines”?

Not all loans will fall within your bank lending guidelines.

Are you concerned that if you say, “you are declined”, etc. that the client will go elsewhere?

Would you rather enhance customer relationship and retain the client by referring them to a source/partner who can approve the loan?

You retain them for other banking services.

It is Win, Win, Win.

Why Capital Is Critical to Small Startup Businesses

Starting a business takes more than a great idea — it takes capital. The right funding gives new business owners the foundation they need to launch, operate, and grow with confidence.

1. Cover Startup Costs

From business registration and equipment to marketing and inventory, every new venture faces upfront expenses. Capital provides the resources to get started strong and avoid unnecessary delays.

2. Maintain Healthy Cash Flow

Revenue doesn’t happen overnight. Having adequate funding ensures you can cover payroll, rent, and day-to-day operations while building your customer base.

3. Fuel Growth and Expansion

Capital gives startups the ability to seize new opportunities — whether that means hiring additional staff, increasing inventory, or expanding into new markets.

4. Build Credibility and Financial Strength

A well-capitalized business sends a strong message to lenders, investors, and suppliers. It demonstrates stability and improves access to future funding options.

5. Stay Flexible and Resilient

With capital in place, startups can adapt, pivot, or weather challenges that often derail underfunded businesses.

At SDA Capital Group, we help small business owners secure the capital they need — fast, flexible, and built for growth.

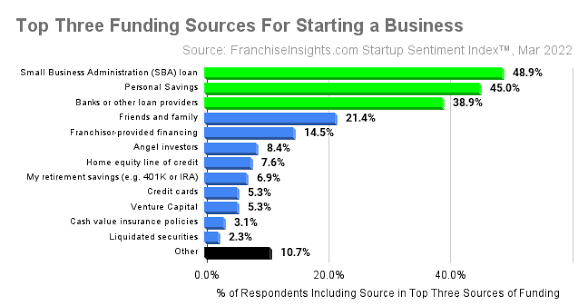

Funding Sources for Starting a Business

Why Retirees Have a Hidden Edge as Entrepreneurs

Retirement is no longer the endgame — it’s the entrepreneurial green light.

By John Rampton • edited by Mark Klekas • Jul 25, 2025

Opinions expressed by Entrepreneur contributors are their own.

Key Takeaways

A built-in network is already available to you

It keeps you mentally sharp and socially active

You’re freer to choose what matters to you

Retirement used to be seen as the end of the hustle, a time to slow down and relax. However, retirees are abandoning that old playbook. Most retirees want to have the time to do the extra things they could not in their lifelong careers.

Due to better health, economic uncertainty and the desire to stay connected to mainstream life and purpose, many people decide to start something new instead of winding down. In fact, 79% of small businesses are owned by people over 50, either baby boomers (30%) or Generation Xers (49%).

Retirement can be a great time to launch a business. Whether to fulfill a long-held dream, make money from a hobby or give back while staying active — here are seven reasons why.

Related: 17 Must-Attend Conferences for Entrepreneurs Ready to Scale

1. You bring experience that cannot be bought

With decades of experience under your belt, imagine walking into a startup meeting. You’ve handled office politics, weathered economic storms and mastered the art of human interaction. It’s not just theory; it’s hard-won knowledge derived from experience. You know what works and what doesn’t and how to pivot gracefully when things go wrong. Young entrepreneurs often learn these lessons on the fly, but what about you? You’re an experienced navigator.

Or, to put it another way, you understand the nuances of customer behavior and the value of a firm handshake. This is a goldmine.

2. You’re freer to choose what matters to you

Corporate ladders? Continually striving for promotion? Those days are behind you now. You now have the opportunity to create something that resonates with your soul.

Have you ever dreamed of opening a bed-and-breakfast that reflects your love of hospitality? What about an online store where you can display your handcrafted treasures? How about a consulting gig where you share your expertise? Perhaps you should start a small nonprofit dedicated to a cause you are passionate about.

Related: The Overlooked Money Moves That Help Entrepreneurs Build Long-Term Wealth

It’s not about climbing a ladder but creating a legacy. Ultimately, creating something aligned with your values and passions brings joy and significance to your life.

3. Time is finally on your side

Do you remember when you were juggling work and family and scribbled business ideas on napkins? You are liberated from that chaos when you retire. You now have time, that precious commodity that has eluded you for so long. Whether you grow your business slowly or quickly, you can plan meticulously, experiment without pressure, and grow at your own pace.

Imagine crafting your business plan over leisurely coffee breaks or testing market strategies without being hampered by immediate deadlines. It’s not about rushing but building something that thrives on thoughtful cultivation.

4. It’s possible to start small and smartly

Don’t be fooled by outdated images of sprawling offices and massive investments. In today’s entrepreneurial landscape, there are a lot of options. For example, with online platforms, remote work tools and a global market at your fingertips, you can start a successful business from home. Also, many retirees start with part-time businesses. They can test the waters and grow organically without being burdened by heavy debt.

You could run a shop on Etsy from your spare bedroom, offer online consulting from your garage or even develop an online product sitting at your kitchen table.

5. A built-in network is already available to you

You have woven a tapestry of connections through decades of professional and personal relationships. However, it’s not just about names in a Rolodex or your contacts in your phone. These are potential partners, collaborators and mentors. In addition to promoting your venture, they can provide invaluable referrals and guidance.

In short, you should never underestimate the power of your network. Despite the digital age, personal recommendations continue to be extremely valuable.

Related: How to Network at Events Like a Pro and Watch Your Startup Soar

6. It keeps you mentally sharp and socially active

Running a business is a mental workout that requires problem-solving, learning, and strategizing on a daily basis. As such, you’ll keep your mind active and engaged, avoiding the stagnation that can creep in after retirement. Furthermore, it lets you stay connected to your community, meet new people, and cultivate a sense of purpose.

Imagine the thrill of learning new digital marketing strategies, the satisfaction of solving a complex business challenge or the joy of connecting with customers who appreciate your work.

7. Your legacy, your way

Here’s your chance to create something lasting, something reflective of your values and passions. This legacy might be a family-run business passed down to future generations. It could also be a brand that brings you immense pride. Or, maybe, it’s a project that makes a tangible impact on your community.

Ultimately, you can build a successful business that embodies your vision, a legacy that positively impacts the world.

The Franchise Directory will return, providing a list of SBA-approved franchises. For aspiring franchisees, this simplifies the loan process and could encourage more entrepreneurs to explore franchise opportunities. Franchises listed on the directory as of May 11, 2023, will have until July 31, 2025, to execute the SBA Franchisor/Distributor Certification to maintain their listing.

Mandatory 10% Equity Injection

Starting June 1, 2025, SBA loans will require a minimum 10% equity injection, with no exceptions. While this has been standard for many deals, some lenders previously allowed no down payment for business acquisitions. This update ensures borrowers have a personal financial stake in their ventures from the start.

Limits on Seller Financing for Equity

The SBA is tightening rules on seller financing. Seller contributions now can only account for up to 50% of the required equity injection, and the financed portion must remain on standby for the full term of the loan. While these measures are designed to increase deal stability, they reduce flexibility for buyers relying heavily on seller financing to close transactions.

Personal Guarantees for Sellers Retaining Partial Ownership

For sellers who retain partial ownership in a business, the SBA will now require a personal guarantee for the full loan amount. This applies regardless of how small the retained stake is. For sellers interested in remaining involved post-sale, this policy adds a layer of financial risk.

Life Insurance Requirements Reinstated

Life insurance policies for borrowers or guarantors will once again be required. These policies protect lenders in the event of an individual's unexpected passing. However, securing SBA-compliant life insurance can take time, so it's important to start this process early when pursuing financing.

Cannabis-Related Businesses' Loan Eligibility

Businesses involved in cannabis-related activities remain ineligible for SBA loans, reflecting federal laws. This applies to companies that grow, sell, produce, or distribute marijuana products, even in states where cannabis operations are legal.

Indirect cannabis-related businesses, such as those selling equipment or services to marijuana companies, may also be excluded. On the other hand, hemp businesses and CBD-related companies may qualify for SBA loans if they meet federal and state regulatory requirements. Borrowers in these industries should consult with an expert to ensure they comply.